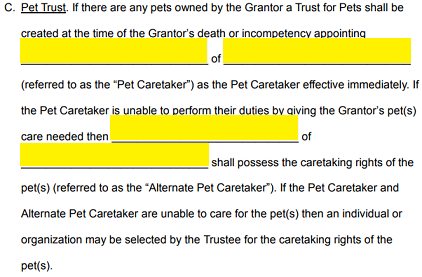

Therefore the person that is selected as the successor trustee will oversee that all the property in the trust will transfer to the beneficiary at the time.

Living trust forms california free download.

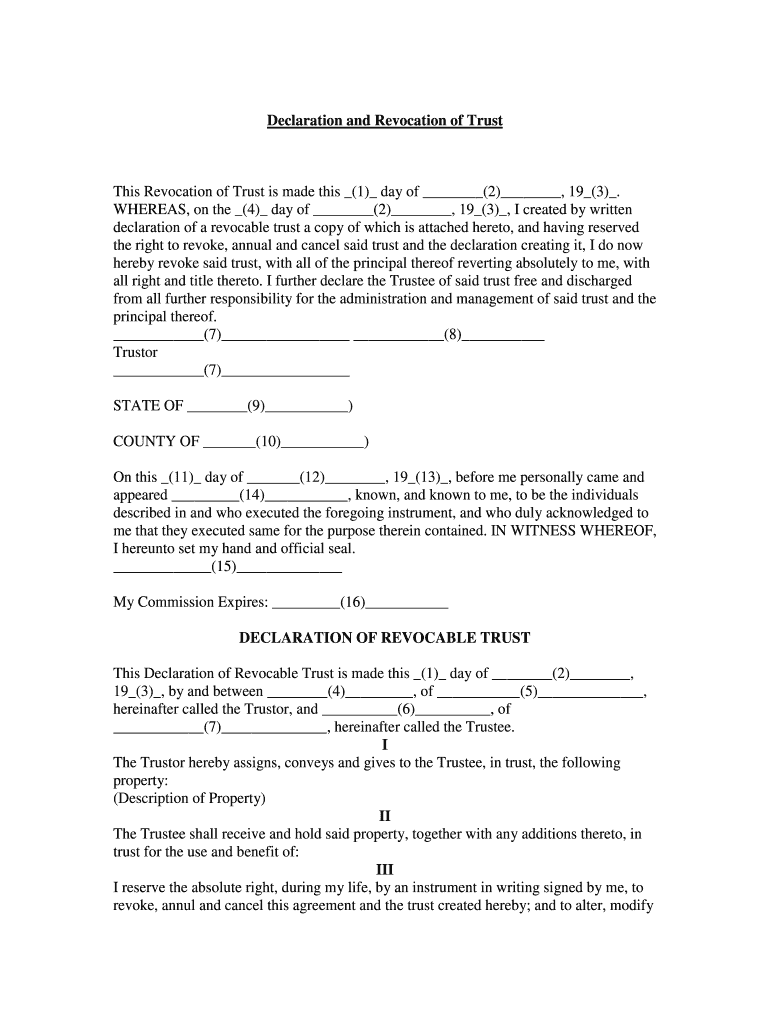

Unlike a will this document is created during the course of the grantor s.

Download the california living trust form which allows you to create a separate entity to hold your chosen assets and property which will continue during your life and after your death until the assets are distributed.

Our free california living trust forms are very popular estate planning tools that can be utilized to avoid probate and court supervision of your assets.

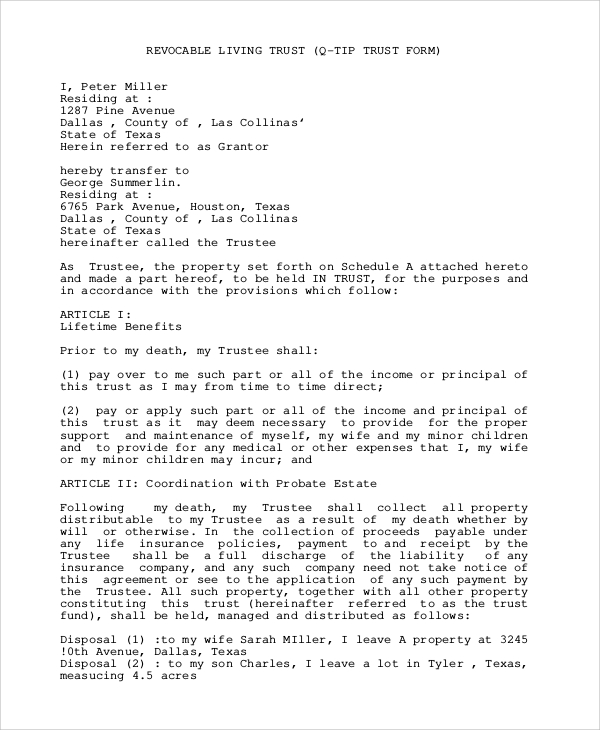

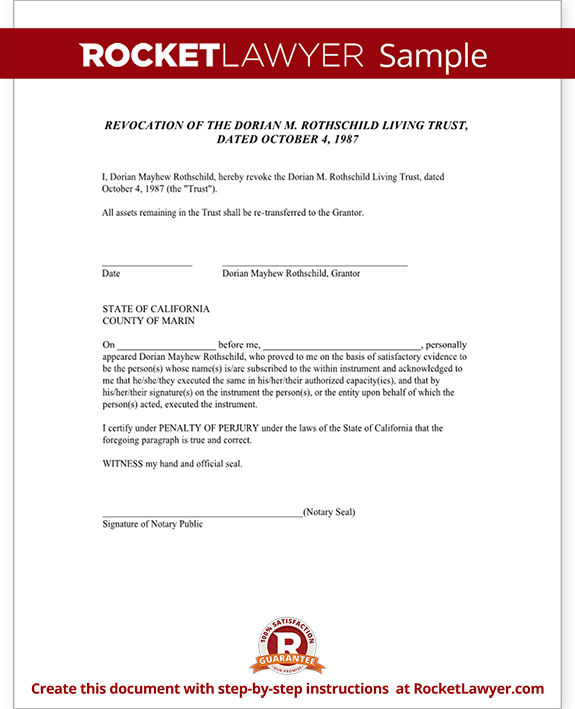

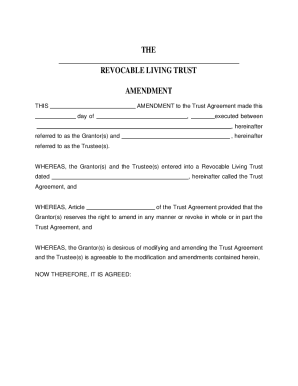

This trust shall be known as the revocable living trust hereinafter known as the trust and is is not an amendment to a prior living trust.

A trustee of your choosing is obligated to administer the trust in a manner which is in the best interest of your beneficiaries.

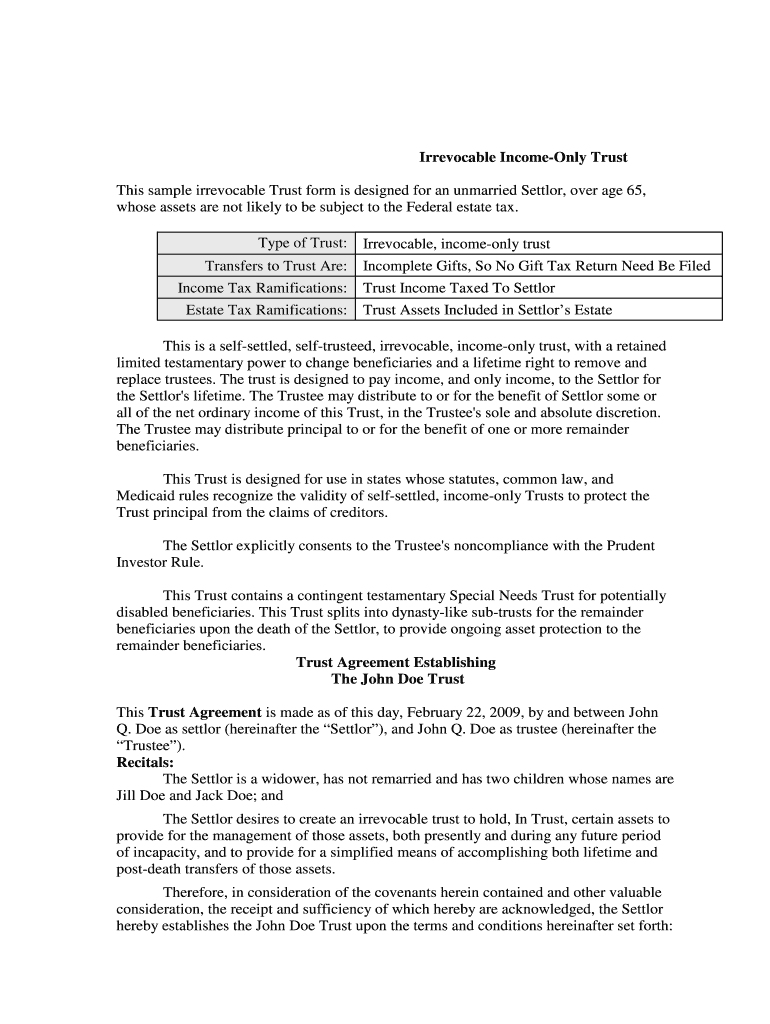

The california revocable living trust is a document that allows a grantor to specify how his her assets and property should be managed during their lifetime and after their death the assets designated to the trust may be managed by the grantor only if the grantor chooses to act as trustee person responsible for maintaining the trust however this option is only available with a revocable trust.

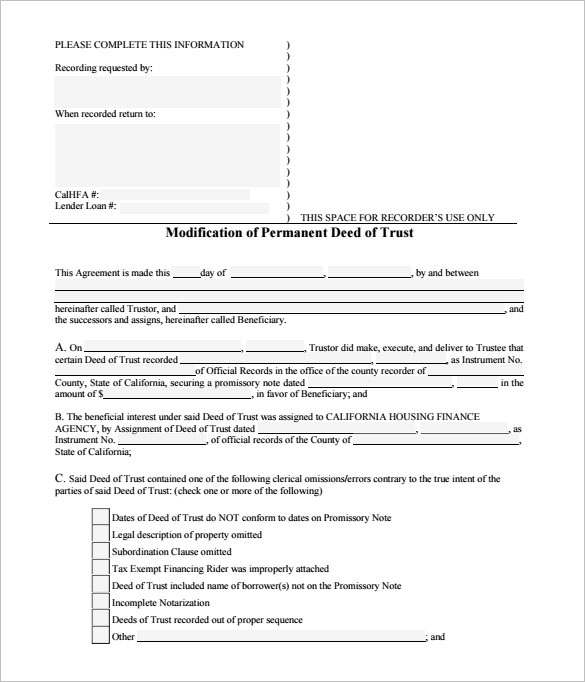

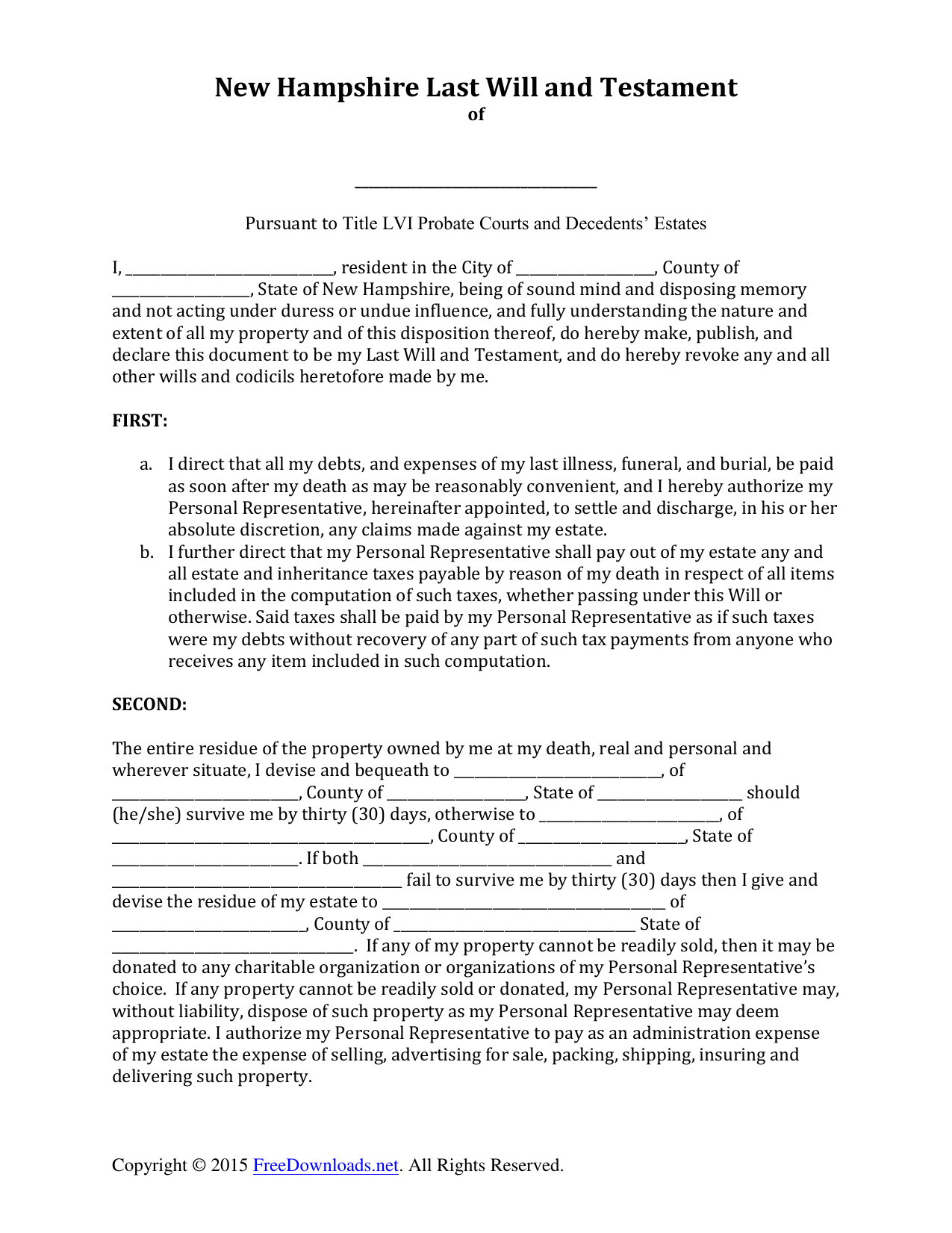

Step 2 the first page of the trust document must have the grantor s name at the top of the page with the date of creation below it.

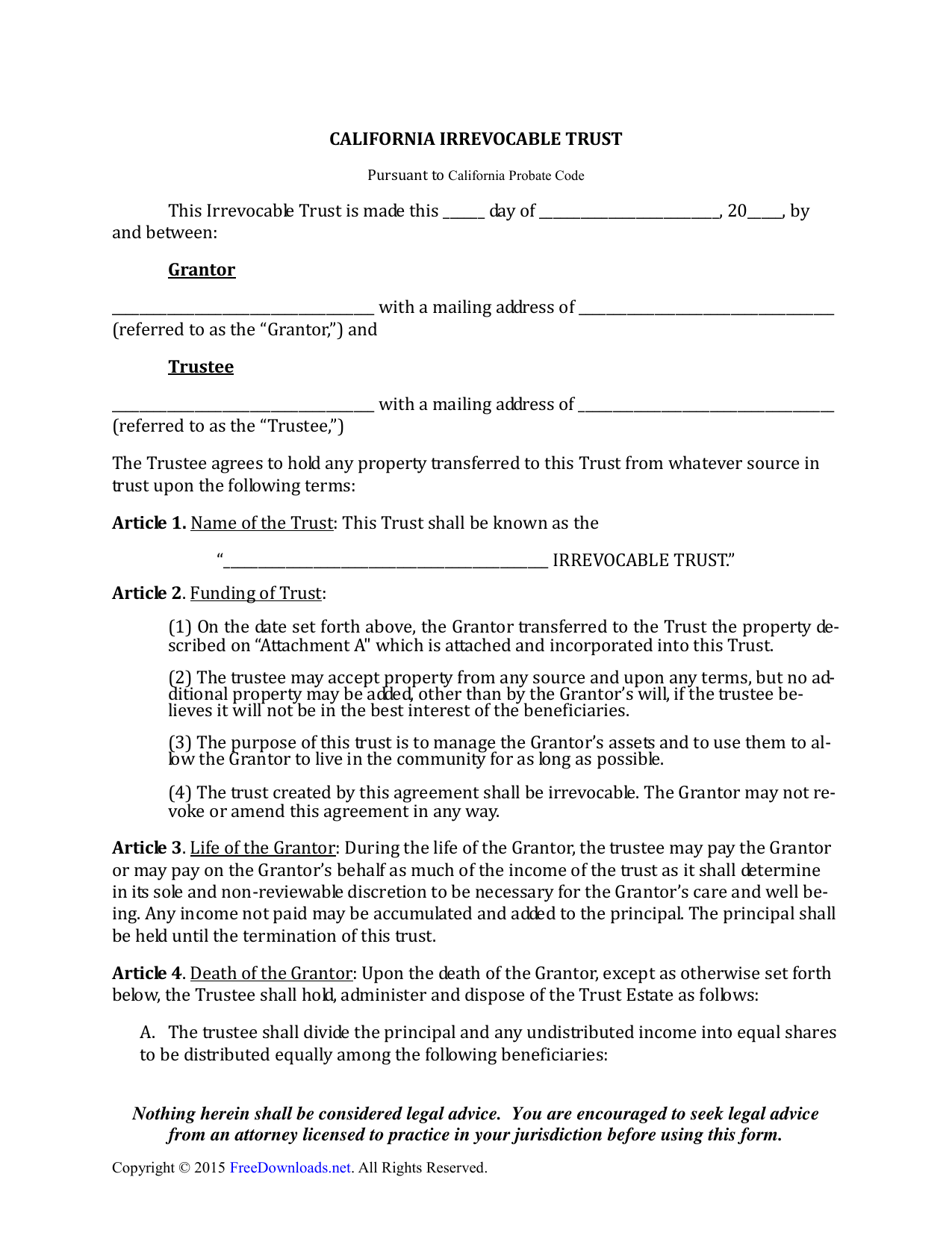

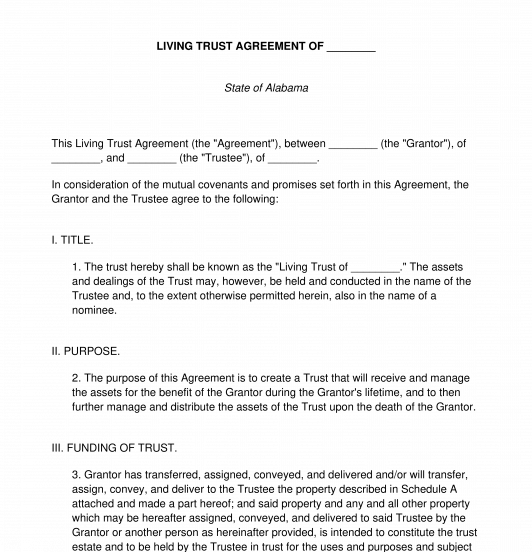

The trustee agrees to hold any property transferred to this trust from whatever source in trust under the following terms.

Next the names and addresses of both the grantor and the trustee.

Step 1 download the state specific form or the generic version in adobe pdf pdf microsoft word docx or open document text odt.

Download free living trust forms online fast.

Name of the trust.

Unlike a will a trust does not go through the probate process with the court.

California living trust forms irrevocable revocable a california living trust is a document that enables an individual to manage their assets both during their lifetime and after death while avoiding the probate process.

After the person dies the trust allows a person s assets to be transferred without delay.

Most of the time disbursement of assets lasts no more than a few weeks and can save the family money and time.

A living trust is designed especially for the survivors to avoid probate.

The person establishing the trust the grantor can place their personal property and real estate within the trust so.